by John Carney – Breitbart Economics Editor and Alex Marlow – Breitbart Editor-In-Chief

Even the economists do not believe the Federal Reserve.

When the Fed met in June, it released economic projections that indicated the central bank would need to hike rates twice more by the end of the year. We’ve noted a few times that the market has been skeptical of that, with derivative prices suggesting just one more hike.

A survey released Thursday by Bloomberg appears to show that the Fed has not won over most economists. Almost all the economists responding to the Bloomberg survey believe the Fed will hike at the next meeting, but just one in five think another hike is on the way after that.

Fewer of the economists in the Bloomberg survey see a recession coming. The share expecting a recession in the next 12 months fell to 58 percent from 63 percent in June and 67 percent in April.

Not only do the economists think the Fed is about to stop raising rates, they also expect more cuts next year than the Fed projections suggest. The median expectation in the Bloomberg survey calls for a rate cut in March with the federal funds target rate falling to 4.75 percent by June and ending the year at 4.25 percent. The Fed’s projections had the target at 4.5 to 4.75 at year’s end.

The Fed funds futures market is pricing in even more aggressive cuts. Prices imply that a rate cut is likely in March and that the target is going to be all the way down to 3.9 percent by year’s end. That seems unlikely unless we get a pretty serious economic slump next year.

You Can Lead an Indicator to a Recession, But You Can’t Make Him Drink

Speaking of which, the Conference Board put out its leading economic index (LEI) for June. The gauge of 10 indicators fell for the fifteenth consecutive month. What’s more the decline is accelerating, falling 4.2 percent over the last six months compared with a 3.8 percent decline in the previous six months.

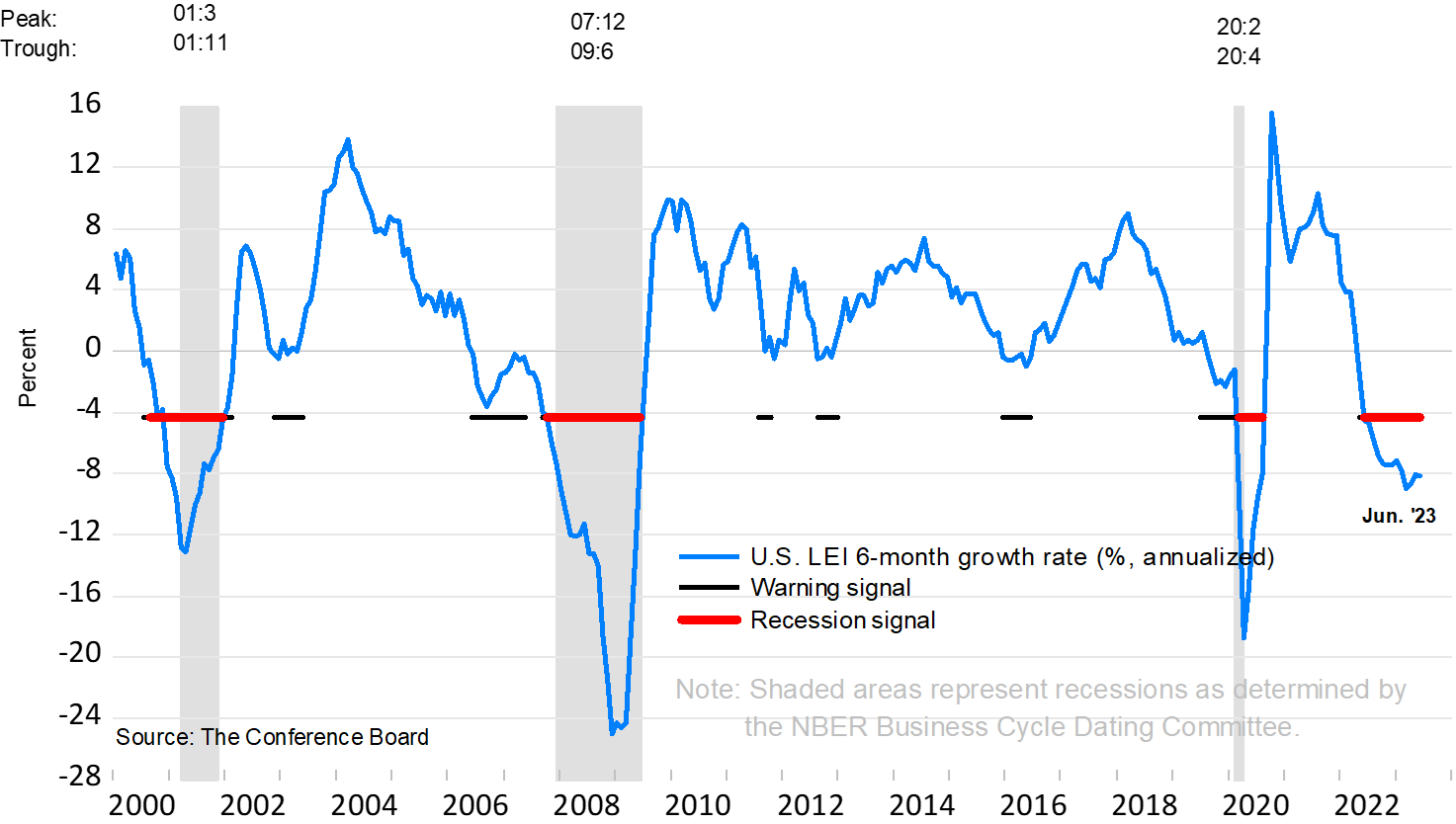

The LEI is telling us a recession in on the way. The chart below illustrates what the Conference Board says is the 3Ds rule, a “reliable rule of thumb” to interpreting the downward movement in the index. The Ds are duration (how long the downturn lasts), depth (how far it falls), and diffusion (how many of the components are weakening).

“The 3D’s rule provides signals of impending recessions 1) when the diffusion index falls below the threshold of 50 (denoted by the black dotted line in the chart), and simultaneously 2) when the decline in the index over the most recent six months falls below the threshold of -4.2 percent. The red dotted line is drawn at the threshold value (measured by the median, -4.2 percent) on the months when both criteria are met simultaneously. Thus, the red dots signal a recession,” the Conference Board said.

As you can see, the recession is now overdue. Assuming we are not now in a recession, this is the longest period of a recession signal being activated without an actual recession arriving.

The same story can be told by looking at the yield curve. The curve inverted—with the two year yield above the 10 year—briefly in April and then went significantly into inversion in July. Lately, it has been dancing around 100 basis points of inversion. On Thursday, the 2-year yield was around 4.841 percent and the 10-year around 3.86 percent. Call it 98 basis points. While that is shy of the peak Volcker 241 basis point inversion back from 1978 to 1980, it is certainly enough to indicate that a recession should be lurking around here somewhere.

Factoring in the Factories

Yet even in the manufacturing sector, hope seems to be springing once again. The Philadelphia Fed’s general business conditions index came in negative for the eleventh consecutive month and missed expectations for a small recovery. The index for new orders—a key measure of demand—declined five points to -15.9, the index’s fourteenth consecutive negative reading. Shipments declined sharply, and that index is now in negative territory.

That all sounds pretty depressing, but Mid-Atlantic manufacturers are actually optimistic. The index for future general activity jumped from a reading of 12.7 in June to 29.1 in July, the index’s highest reading since August 2021. Nearly 40 percent of the region’s manufacturers expect an increase in activity over the next six months, up from 33 percent last month. Just 11 percent expect a decrease, down from 20 percent. Forty-six percent expect no change (up from 44 percent).

The future new orders index soared 24 points to 38.2, while the future shipments index rose nine points to 37.3. Manufacturers held employment steady in July and say they continue to expect increases in employment over the next six months. There’s even a bit of immaculate disinflation in the report, with prices expected to rise only slightly.

So, do the folks in the factories in Pennsylvania and Delaware not know how to read the yield curve or the leading index? Or could the traditional recession indicators be sending up a false alarm? Our read is that we are headed for a recession but not this year.