Operation Second Chance tightened its budget and cut some programs this year to account for a sudden $93,000 tax bill.

SABILLASVILLE, Md.—Dark thunderstorm clouds parted and a double rainbow appeared just as a family pulled up at Heroes Ridge at Raven Rock, home of Operation Second Chance, a nonprofit retreat that benefits wounded veterans and their families.

“We thought we were entering heaven,” a family member said upon arrival, according to Cindy McGrew, founder and CEO of Operation Second Chance.

The picturesque mountaintop on the border of Maryland and Pennsylvania in the Blue Ridge Mountains really is a slice of heaven, Ms. McGrew told The Epoch Times; it’s meant to help heal spirits broken by trauma experienced during military service.

Operation Second Chance hosts battle buddies, caregivers, families, groups, and individuals from around the United States in cabins accessible for amputees and wheelchair users.

The experience is free for guests, including travel expenses, activities, and food. The organization also provides grants to wounded veterans who are facing financial struggles, helping with house and car payments, medical supplies, and emergency assistance.

The Mason-Dixon line runs through the property, a former church camp, and nearby Camp David, the presidential retreat, can be seen in one direction. From a wooded peak in another direction, veterans can sit by a bonfire overlooking the iconic Gettysburg battlegrounds, watch the sun go down, and talk with others who understand what they’ve seen, what they face, and how they feel.

But since Operation Second Chance bought the property in 2020, more dark clouds have loomed over Heroes Ridge. Two years after the organization bought the property, an unexpected tax bill arrived from Adams County, Pennsylvania.

The bill, for more than $92,000, is the sum of a seven-year claw-back of a property tax discount through Pennsylvania’s Clean and Green environmental tax-break program.

Operation Second Chance, a nonprofit retreat benefiting wounded veterans, is based at Heroes Ridge in the Blue Ridge Mountains, on the border of Maryland and Pennsylvania. (Madalina Vasiliu/The Epoch Times)

Clean and Green

Heroes Ridge is a 275-acre, mostly wooded property with 25 acres in Frederick County, Maryland, and the rest in Adams County. The Frederick County portion is tax-exempt because Operation Second Chance is a nonprofit. But Adams County hasn’t granted the same exemption.

“We purchased this property in October of 2020, cleaned up the buildings that were already here, made them livable again, and brought life back to them,” Ms. McGrew said.

“Then last year, 2022, just a few days before Thanksgiving, I received a call saying it was a courtesy call because we were going to get a tax bill for just over $92,000.

“I said, ‘Well, that’s impossible because we did a title search, and there was no money owed on the property, and we’re paid up on our taxes.’ And they said, ‘No, the property came out of Clean and Green when you purchased it.’ And I had no idea what that meant.”

The Pennsylvania Farmland and Forest Land Assessment Act is a state law that allows qualifying land devoted to agricultural or forest use to be assessed at lower than fair market value through the Clean and Green land preservation program. It’s intended to encourage property owners to keep most of their land in agricultural, open space or forest and not develop it. The program provides real estate tax relief and is favored by owners of large tracts of land.

The previous owner put the land in the Clean and Green program for forest preservation in 2011 and paid a lower tax rate, according to records from the Adams County Register and Recorder’s Office. Ms. McGrew continued to pay at that rate until she received that phone call.

The tax bill came with a fine for nonpayment of $588 per day, Ms. McGrew said, which came to about $17,600 per month. Attorney Joseph Erb of Hanover, Pennsylvania, advised her to pay the bill to avoid racking up more fines and to then ask the county to return the money.

Cindy McGrew, founder and CEO of Operation Second Chance, was caught by surprise when she received a tax bill for more than $92,000. (Madalina Vasiliu/The Epoch Times)

By then, Operation Second Chance owed more than $93,000, so Ms. McGrew wrote a check to Adams County and paid the bill.

“I told them, ‘You have just prevented me from providing emergency assistance to 50 to 70 families. Most donations are intended to go to the veterans, not to pay back taxes.’”

Ms. McGrew is now asking for the money to be given back to the nonprofit. The Adams County Commissioners recently held a hearing on the matter and are expected to give their decision in mid-November.

“We just feel like it’s the right thing to do, to give the money back,” Ms. McGrew said. “I’m praying. I’ve lost so much sleep over this, and I’ve cried. I woke up in the night crying. And finally, one day, I looked at the tax bill, and I put it in my Bible, and I said, ‘Lord, I’m giving this to you because I can’t worry about this anymore.’ I know things happen in his time. I’m praying that we get that tax money back so we can help other veterans.”

Operation Second Chance tightened its budget and cut some programs this year to account for the tax bill.

Normally, it gives $35,000 in scholarship money to high school seniors who have an injured family member, but this year, it gave $10,000 in scholarship money. It also paid less in emergency financial assistance this year.

“It takes a lot to run this retreat center. We pay for everything for the veterans to come here. We pay for their flights—they’re coming from all over the country. There’s no cost to the veterans to come here. We want them to come here and be relaxed and just spend time bonding together, enjoying themselves.”

Tax Dispute

When a buyer purchases a property that’s already enrolled in Clean and Green, they must update the program’s application with their information, which usually triggers an additional review of the status, Adams County Solicitor Sean Mott told The Epoch Times. The review determines if the property has had a change of use that could take the land out of the program and trigger a seven-year rollback of the amount of taxes that weren’t paid because of the discount.

“In this case, it appears that the Tax Service Department sent a letter to Operation Second Chance on Dec. 8, 2020, indicating that they would need to file an amended application to determine whether the land continued to be used in accordance with Clean and Green,” Mr. Mott said. “That letter went unanswered, and so a second letter was sent on May 25, 2022, which also went unanswered.”

Ms. McGrew said she never received those letters, but in August 2022, someone from the county tax office visited Operation Second Chance with a letter in hand regarding Clean and Green. That letter didn’t have the right address and wasn’t addressed to the right person, she said. She asked him to check his records, address them properly, and mail them to Operation Second Chance.

In Pennsylvania, exemption from taxation is allowed under two categories of landowners: religious organizations that use property for worship and “purely public charities,” so long as the land is actually used in furtherance of their charitable mission.

Operation Second Chance applied in 2022 for a tax exemption under the Institutions of Purely Public Charity Act, Mr. Mott said, “which was only granted in part, as they were only able to provide evidence of charitable use (i.e., the veterans retreat) for 26.95 acres of the roughly 250 acres (most of which is undeveloped). So 26.95 acres of the total property are completely exempt from property taxes.”

Veterans can sit by a bonfire overlooking the iconic Gettysburg battlegrounds and have conversations that create bonds between one another. (Madalina Vasiliu/The Epoch Times)

Now, Adams County considers the land on which the buildings are located as a nonprofit and exempt from taxes, but the undeveloped land—which Clean and Green seeks to preserve as forested land—isn’t being used enough by Operation Second Chance to qualify for the nonprofit tax exemption.

“Essentially, the activity that qualified Operation Second Chance for tax exemption under the Institutions of Purely Public Charity Act was an ineligible use under the Clean and Green law,” Mr. Mott said.

“However, even though a rollback was assessed for ineligible use under Clean and Green, Operation Second Chance was able to re-enroll that portion of the property that did not qualify for full exemption (about 220 acres), beginning in 2024. So roughly 27 acres are fully exempt from taxation for charitable purposes, and 220 acres will receive preferential tax treatment under Clean and Green.”

The Veterans

In 2004, Ms. McGrew started visiting wounded veterans in Bethesda, Maryland, at Walter Reed National Military Medical Center. Her brothers had served in Vietnam, and she vowed that she would always care for veterans.

At Walter Reed, she stood in for parents and spouses of the wounded when they couldn’t be there, holding hands, listening to their concerns, and filling various needs that came up, such as purchasing a playpen for a visiting baby. Her co-workers handed her money and said, “Give this to your veterans.”

Veterans and their families can enjoy their time at the Operation Second Chance retreat for free, including travel expenses, activities, and food. (Madalina Vasiliu/The Epoch Times)

This morphed into Operation Second Chance, allowing Ms. McGrew to help more veterans. Since its start, the nonprofit has provided more than $9 million in assistance to veterans and their families through public donations.

“We’ve got guys and gals that are surviving catastrophic injuries that they would not have survived in previous wars,” Ms. McGrew said.

“Some are from rural America, they want to get out of a bad situation by joining the military, or they are very patriotic and want to take a stand and fight for our country. If they’re wounded, they only get a percentage of that pay for life. If you saw their paycheck, for many of them, it’s not enough to live on. If you’re in Montgomery County, Maryland, for instance, you could not live on $1,700 a month, and that’s what some will make. It depends on their rank. I don’t have all the answers for that, but I know if [the nation] were doing our job, you wouldn’t need nonprofits.”

Many veterans wait until the last minute to ask for help hoping that something in their circumstances will change, she said.

Visitors to Heroes Ridge enter a gravel lane through an electronic security gate and drive about a mile uphill before cresting at the mountaintop, where the main activities are located. There are several cabins for families, a recreation building, a chow hall, a main house and pool, and an outdoor arena for horses. An indoor horse-riding arena is planned where the outdoor arena is located so that they can continue their horse program in all weather.

Mr. Maddox and Ms. McGrew demonstrate the roping technique. When wounded veterans try rodeo roping, they get so focused that they often forget their disability for a moment, according to Mr. Maddox. (Madalina Vasiliu/The Epoch Times)

The security gate and large areas of forested land surrounding the main buildings help those who are suffering from post-traumatic stress disorder feel safe. There are hiking trails in the forest.

Veterans and their families who visit Operation Second Chance are often adjusting to major life changes, and the entire visit is geared to build morale. The horse program is one of the most memorable activities at the retreat. Four rodeo team roping horses, named Pepsi, Loops, Cactus, and Jake, stand in the ring at the center of the property. Hector, an outrageously friendly donkey, is there, too.

Veterans are taught how to throw a lasso over the horns of a dummy steer. Then, they get on a horse and try to rope the dummy steer while it’s pulled around the ring.

“The object is to get what’s on your mind off your mind,” Operation Second Chance’s resident cowboy Greg Maddox told the Epoch Times.

He says 95 percent of the wounded veterans who visit have never ridden a horse, or at least not since childhood, and now they’re asking a lot from their bodies. But when a double leg amputee or someone with a traumatic brain injury gets up on a horse, they move like everyone else who’s on a horse. They get so focused on riding the horse and roping the steer that they often forget their disability for a moment.

It builds confidence as they see themselves in a new light.

Some are nervous around the horses and stand outside the fence. That’s when Hector the donkey walks over, nudges, and insists on being petted. Hector breaks the ice, and soon, the veterans are in the ring interacting with the horses.

Hector is a very friendly donkey who enjoys meeting visitors. (Madalina Vasiliu/The Epoch Times)

“You can see their body language change,” Mr. Maddox said, as they go from nervous to relaxed to practicing riders and ropers.

Veterans who can’t ride horses can benefit from interacting with them. Horses have a way of understanding our emotions, and they meet people where they are, according to Ms. McGrew.

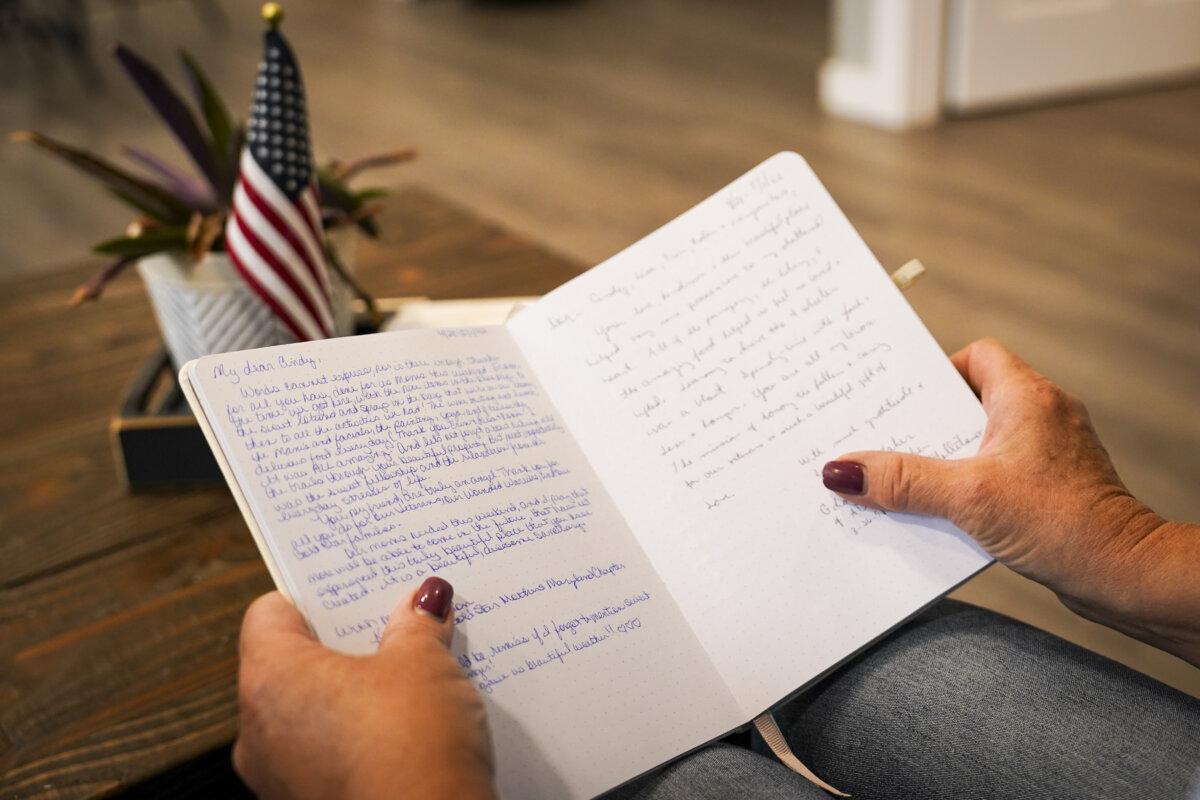

The cabins have notebooks in which former guests have written heartfelt letters.

“If you want my honesty, last week, my only plan was to shoot my dog and then myself. It’s real. That’s all I had,” one wounded veteran’s entry said. “Now, as I sit here, momentum growing in my stomach, I can finally feel God again, whispering into my heart that the powers that be within my soul, once harnessed in self-love, is a power that can crush evil, not out of vengeance but out of love and fierce loyalty to compassion. If you feel like God has left you, you gather those that are capable of loving you and come up with a plan.”

The cabins have kitchens, but Ms. McGrew has found that guests prefer to gather together in one place for meals. If they don’t know each other before arrival, they usually exchange information to stay in touch before leaving. Sharing meals, rodeo roping, and campfire conversations creates bonds not only between wounded veterans but also among their spouses and children.

“It is an honor to take care of this place and to be able to share it,” she said.