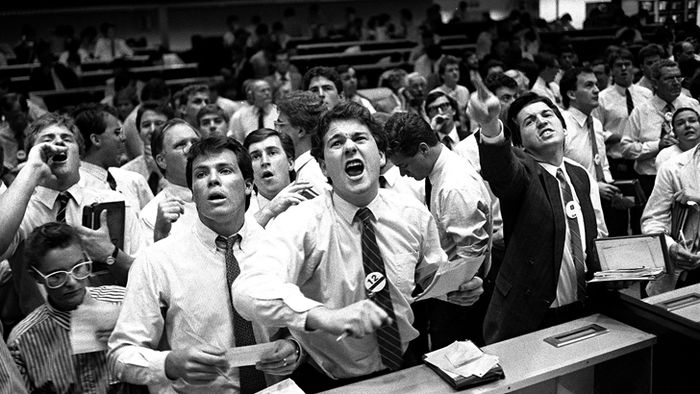

Global markets fell like dominoes on Monday. Japan’s Nikkei index was the first to plunge, suffering its biggest rout since the 1987 Black Monday crash. The stock exchanges in Europe and the United States followed, triggering a selloff that further fueled fears about the broader economy. The Dow, S&P 500, and Nasdaq sank by 2.6 percent, 3 percent, and 3.4 percent respectively at the closing bell. During trading hours, Wall Street’s fear gauge, the VIX, soared to the highest level since 2020.

Recession fears were the primary driver of the stock market selloff. Domestic financial markets have been in a slump since the Aug. 1 trading session, when a pair of manufacturing reports showed a sector in contraction.

The July jobs report revealed a smaller-than-expected 114,000 new jobs and a higher-than-expected 4.3 percent unemployment rate, which triggered the Sahm Rule. This is a key indicator that suggests the country might be in the early months of a recession when the three-month unemployment moving average rises 0.5 percentage points above the 12-month low.